Figuring hourly pay

Pay each week generally on the same day each pay period. However you dont have to withhold federal income tax or pay FUTA tax on the cost of any group-term life insurance coverage you provide to the 2 shareholder.

How Is Labor Cost Calculated Your Simple Guide Hourly Inc

The rate increases as the income increases.

. Careers Biden appoints 1st Native American as. John Chayka was 26 when he. How Much Does a Virtual Assistant Make.

For example if your receptionist worked 40 hours a week at a rate of 20 an hour his gross pay for the week would be. What is the current hourly pay rate for a nanny in my area. Hourly rates the most common way to charge for home care services range from as low as 18 an hour in smaller towns to as much as 40 an hour in the larger cities.

This approach is often taken by agencies that manage teams of writers because it helps them keep the budget in check. A portrait photography photoshoot and print package runs 150 to 300. There are many factors that influence the costs of a babysitter or nanny including location skill level and the number and ages of the.

To calculate your take-home pay follow these steps. For hourly employees gross pay is the number of hours worked during the pay period multiplied by the hourly rate. OR b forty 40 times the higher of the minimum hourly wage set by federal law or state law.

When figuring social security and Medicare taxes you must also include the cost of this coverage in the 2 shareholders wages. Pay 4 times a year. Pay every other week generally on the same day each pay period.

Consider adjusting the 1 in the formula to payparticipants probably get paid somewhere around 3000 per episode. Based on the millions of job posts on the site here are the 2022 average hourly nanny pay rates in several major cities. Pay on specified dates twice a month usually on the fifteenth and thirtieth.

Salaried employees are usually issued the same amount on each paycheck earned so figuring out their retro pay is. Whichever is the larger amount. How to calculate retro pay for hourly employees.

To begin youll need to determine what you did pay the employee for the hours they worked. As an example if you make 30000 a year without overtime then your tax bracket falls into the 9951 to 40545 category according to the 2021 tax season. On page 2 of this form are the sections of the Connecticut General Statutes which your employer must follow to figure out calculate the weekly amount that may be taken out of your wages to agree with the wage execution.

What Are the Differences. Pay on a specified day once a month. Gross pay is the original amount an employee earns before any taxes are withheld.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Include the cost in boxes 1 3 and 5 of Form W-2. When you join the Giant Eagle yourre joining a team that is committed to your growth both personally and profesionally a diverse team that will always have your back and the opportunity to help our community thrive.

Big brother an im a celebrity contestants get between 20000. Feb 09 2022 What Does DoorDash Pay. How to calculate take-home pay.

Some realistic estimates of their monthly income sit between 1250 and 10875 for general Virtual Assistants while VAs with specialist skills such as graphic design copywriting SEO web development and other such specialties generate. But drivers themselves report closer to 7-10 per delivery and not usually more than 3 deliveries in an hour. In May of 2018 32-year-old Kyle Dubas became the youngest general manager in the history of the Toronto Maple Leafs and the second youngest in the history of the NHL.

DoorDash themselves advertise hourly pay ranging from 10-25 an hour for their drivers. Determine a reasonable estimate of how long your HIT will take. Calculating retroactive payments for hourly employees is relatively straightforward.

Pay 2 times a year. When figuring out how much to pay for child care its important to offer fair competitive babysitter rates or nanny rates. Before figuring out what to pay its important to consider what a blog is worth to your business.

The higher you are on the bracket the higher your income and the more taxes you pay. Virtual Assistants worldwide can make anywhere between 7 and over 63 per hour. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

The average cost to hire a photographer is 100 to 250 per hour depending on their skill level. You may have pretax or after-tax deductions that you can subtract from your salary before or after figuring out the amount of income tax due. Figuring out what DoorDashs pays can be a little more difficult that you might expect.

By the Word Paying by the word eliminates the vagaries of hourly billing assigning value to output instead of time. College graduates get better jobs at higher pay along with flexible hours remote work and student debt repayment as employers face worker shortages. Heres a handy formula for figuring out how much you should ideally pay participants.

Event photographers charge 150 to 250 per hour with a 2-hour minimum while a wedding photographer costs 1000 to 3000 for 6-hours. For example you could have a 6 contribution to a 401k. So its not like.

Figure Out Gross Pay. After all youre investing in the person who is taking care of your little one. The national average for non-medical home care services is currently 24 an hour.

Join us and discover a place to build your future.

Salary To Hourly Calculator

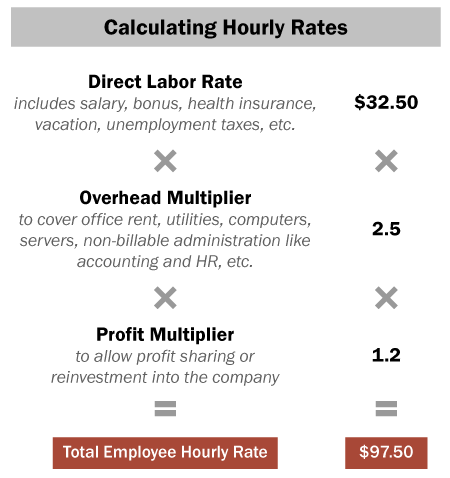

6 Steps To Calculate Hourly Billing Rate For Architects

6 Steps To Calculate Hourly Billing Rate For Architects

Biweekly Paycheck To Hourly Wage Conversion Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Calculate Overtime Pay From For Salary Employees Youtube

6 Steps To Calculate Hourly Billing Rate For Architects

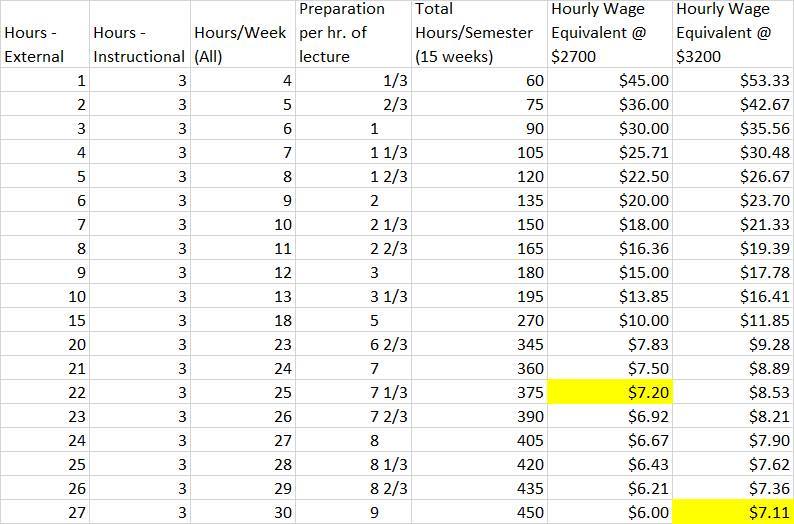

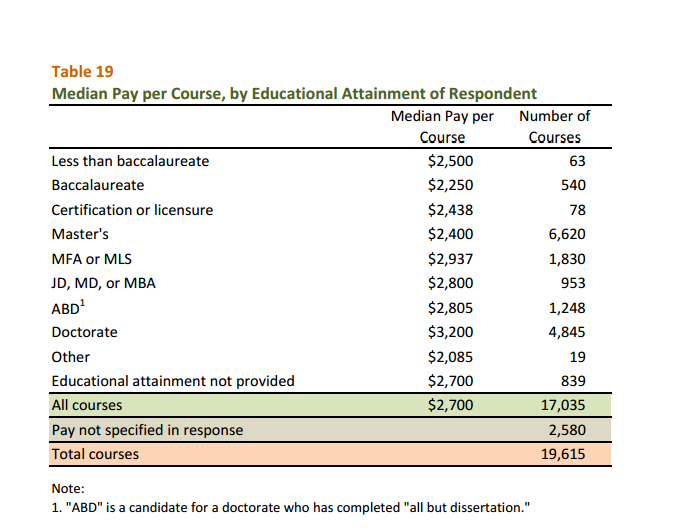

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

6 Steps To Calculate Hourly Billing Rate For Architects

Gross Pay And Net Pay What S The Difference Paycheckcity

How Much Rent Can I Afford On My Hourly Pay My First Apartment First Apartment Apartment Checklist First Apartment Checklist

Calculating Hourly Pay For Secondary Special Education Life Skills Students Life Skills Special Education Special Education Special Education Students

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Calculating An Architectural Fee For Services Archtoolbox

How To Calculate Overtime Pay From For Salary Employees Youtube

6 Steps To Calculate Hourly Billing Rate For Architects

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator